Maximize Your Refund with Complete Income Tax

Expert Income Tax Services to Minimize Your Taxes and Maximize Your Savings

About:

Complete Income Tax is dedicated to providing comprehensive income tax services. With a team of experienced professionals, we ensure accurate and efficient tax preparation, filing, and advisory services. Our mission is to help individuals and businesses navigate the complexities of income tax laws, maximize deductions, and minimize liabilities. Trust Complete Income Tax for expert guidance and personalized solutions to meet your tax needs.

Understanding Income Tax: A Comprehensive Guide

Importance of Income Tax

Income tax is a crucial source of government revenue used for public services and infrastructure. Understanding its significance helps individuals comply with tax laws and contribute to the nation's development.

Taxable Income Components

Recognizing various sources of taxable income such as wages, investment gains, and rental income empowers taxpayers to accurately report their earnings. Understanding these components ensures compliance with tax regulations.

Tax Deductions and Credits

Familiarity with tax deductions and credits enables taxpayers to minimize their tax liabilities. Being aware of eligible expenses and credits can optimize tax planning and maximize potential savings.

Maximizing Deductions and Credits: Navigating the Income Tax Landscape

Keep Detailed Records

Maintain organized records of all expenses and receipts to maximize deductions. Proper documentation is essential to claim expenses for business, medical, or charitable purposes.

Take Advantage of Tax Credits

Explore available tax credits such as education, childcare, or renewable energy credits to reduce tax liability. Research and understand eligibility criteria to maximize potential savings.

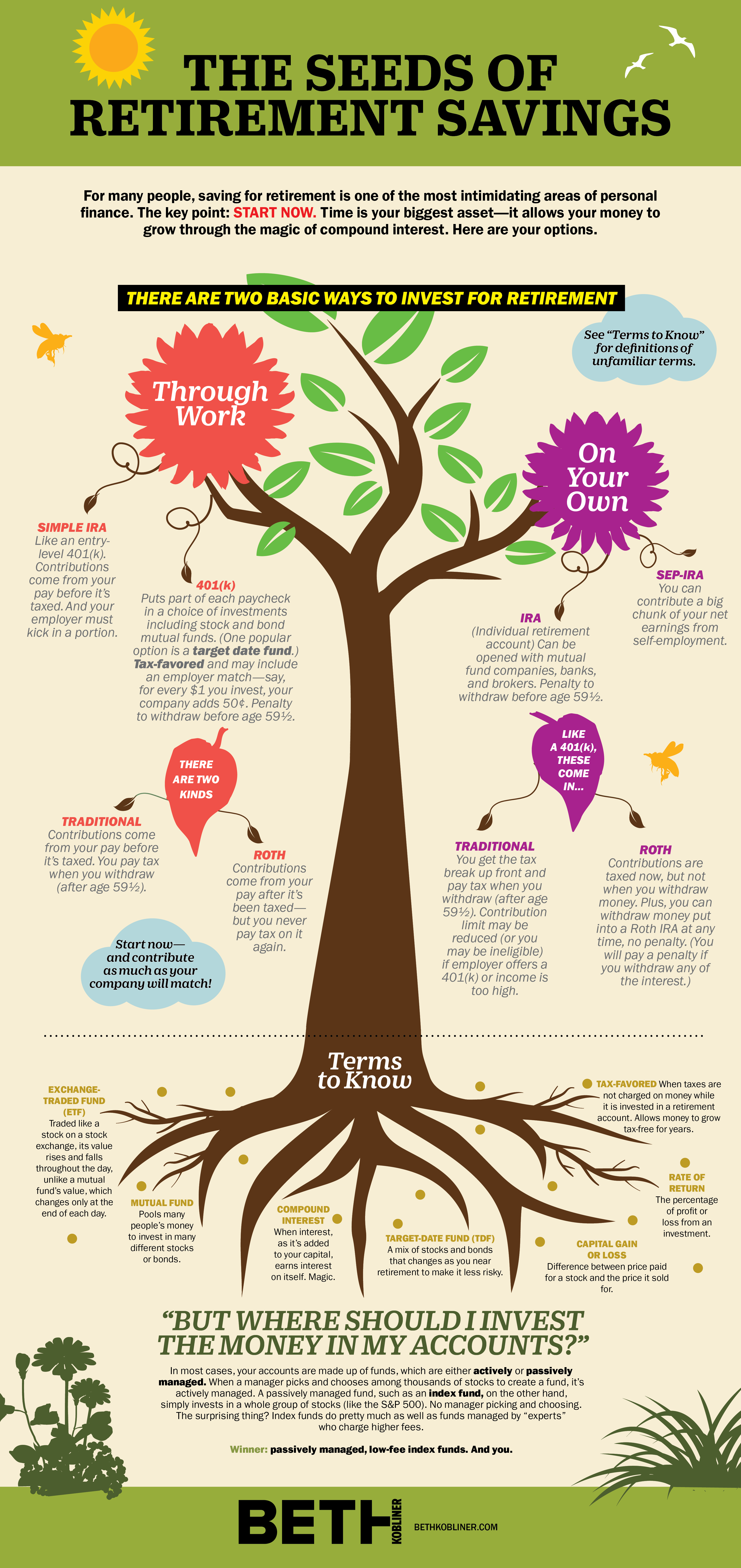

Utilize Retirement Savings Accounts

Contribute to retirement accounts like 401(k) or IRA to lower taxable income. By maximizing contributions, individuals can benefit from tax-deferred growth and potential tax deductions.

Income Tax Tips and Strategies: Optimize Your Tax Planning

Maximize Deductions

Take advantage of all available deductions, such as charitable contributions, home office expenses, and medical expenses to reduce your taxable income.

Utilize Tax-Advantaged Accounts

Contribute to retirement accounts like 401(k) and IRA to lower your taxable income and take advantage of tax-deferred growth.

Plan Timing of Income and Expenses

Consider deferring income to the next tax year and accelerating deductible expenses to the current year to manage your taxable income effectively.

Our Services.

Tax Preparation

Expert assistance in preparing and filing your income tax returns accurately and efficiently.

Tax Planning

Customized strategies to minimize tax liabilities and maximize potential deductions for your financial future.

Tax Consultation

Personalized advice and guidance on complex tax issues, ensuring compliance with current tax laws and regulations.

Maximize your tax returns and minimize your stress with our expert income tax services!

Testimonials

I used Complete Income Tax for filing my taxes, and they made the process so easy and stress-free. I highly recommend them!

Jesse B.

Thanks to Complete Income Tax, I got a much higher refund than I anticipated. Their team is knowledgeable and efficient.

Jenny T.

Complete Income Tax helps you navigate through complex tax situations with ease. Come see.

Jaime Bowen

Complete Income Tax

© Copyright 2023

Complete Income Tax